Eurizon Fund -

Equity Circular Economy

A global equity investment focused on the circular transition

We believe the circular economy could act as a driver for more sustainable, smart, and inclusive growth. Eurizon Fund - Equity Circular Economy offers a new opportunity to invest in the best-structured companies that are on a transformation path, aiming to achieve more stable profits and cash flows, and stronger customer loyalty. Companies are selected through a bottom-up process that identifies companies with standardised metrics, paying particular attention to a proprietary circularity score, free cash flow yield, and the internal ESG score. The objective is to outperform the benchmark, namely the 100% MSCI World index (EUR). The fund is actively managed, and the benchmark is used for measuring performance and calculating performance fee*.

SFDR: The Fund promotes, among other characteristics, environmental or social characteristics as per Article 8 as per Regulation (EU) 2019/2088 on sustainability‐related disclosures in the financial services sector (“SFDR”).

The advantages of investing in the best-structured, leading companies in the circular transition

Companies that have a good level of circularity and operate in the sectors most exposed to linear risks have a better risk profile and a competitive edge over peers, thanks to their ability to anticipate market trends.

Leading circular economy companies are expected to enjoy more stable earnings and cash flows in the medium-long term, in reward for the short-term investments required to make the transition to a circular model.

These companies are able to strengthen customer loyalty by offering services that complement and replace products.

Investment Process

The fund uses a bottom-up approach to analyse and select companies using standardised metrics and proprietary indicators, such as a circularity score, free cash flow yield (FCFY), and ESG risk estimation.

Companies are classified into four distinct categories depending on their role in the transition to a circular economy (“leading the circular transition”, “facilitators”, “suppliers”, “other companies”). Within each category ("Circular Transition", "Facilitators", "Suppliers"), each company is inserted in a group ("Cluster") with a score from 1 to 5 based on the quality of its metrics in terms of circular transition, ESG risk management, and Free Cash Flow Yield estimation.

Some companies may be inserted in more than one category, depending on their characteristics.

Find out more about Circular Economy and the product

Main Risks of the sub-fund

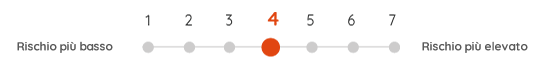

The risk indicator assumes you keep the product for 4 years.

The summary risk indicator is a guide to the level of risk of this product compared to other products. It shows how likely it is that the product will lose money because of movements in the markets or because we are not able to pay you. We have classified this product as 4 out of 7, which is a medium risk class. This rates the potential losses from future performance at a medium level, and poor market conditions could impact the capacity of Eurizon Capital S.A. to pay you. This fund does not offer any form of capital protection against future negative market conditions and, as a consequence, you may lose part of or the entire amount originally invested. If the fund is not able to pay you out what is due, you may lose your entire investment.

Main costs: (Illustrative class: LU2357530901 – registered in AT, BE, CH, DE, SP, IT, LU, PT, SK): Entry charge: 0%, Exit charge: 0%, Ongoing charge: 0,78%, Performance fee: 0,15%. The performance fee calculation is based on a comparison of the net asset value per unit against the High Water Mark where the High Water Mark is defined as the highest net asset value per unit recorded at the end of the five previous financial years, increased by the year-to-date return of the fund's benchmark. The actual amount will vary depending on how well your investment performs. The aggregated cost estimation above includes the average over the last 5 years.

Management team

Key features**:

- High seniority team that has been working together for 10 years

- The team has developed and updated the management model

- The team manages 50 funds/subfunds

- The team manages total AUM in excess of 16 billion euros

Useful insights

Notes

* There can be no assurance that the investment objective will be achieved or that there will be a return on capital. The fund does not benefit from any guarantee to protect the capital. Past performance does not predict future performance.

** Data as of: 31/03/2024

This marketing communication relates to Eurizon Fund (The “Fund”), a Luxembourg UCITS in accordance with Directive 2009/65/CE and the Luxembourg Law of 2010. This document is issued by Eurizon Capital S.A. organized as a public limited company in Luxembourg, at 28, boulevard Kockelscheuer, L-1821 Luxembourg, and authorised as management company of the Fund under the Law of 2010. This marketing communication is intended for professional investors as defined in the European Directive 2014/65/EU (MiFID) or relevant legislation in countries where the Fund is registered for distribution and is not intended for retail investors nor US Persons. Before taking any investment decision, read the Prospectus, the Key Information Document (the “KID”), and the last annual or semi-annual financial report, available in English (and the KIDs or in authorized language) on the website www.eurizoncapital.com.

This document does not constitute any legal, tax or investment advice. Past performance does not predict future returns. There is no guarantee that the forecasts will be reached in the future. Liaise with your tax and financial advisor to find out whether a product is suitable to you and understand the related risks and tax impacts. The tax treatment depends on the individual circumstances and may be subject to change in the future. A summary of investor rights is available in an official language (or authorised language) at www.eurizoncapital.com/en/investors-rights.

The Management company reserves the right to terminate the marketing arrangements of the Fund in your country. Before investing, read the risk section of the prospectus and the specific risks and costs related to the Fund. Also read the SFDR Pre-contractual disclosure, and the documents available in English or in authorized language, in the “Sustainability” section of the webpage: www.eurizoncapital.com.

SWITZERLAND:

In Switzerland this document is an advertising as per the Federal Act on Financial Services (FinSA), is intended for professional and institutional investors only and is not intended for retail investors. The representative and paying agent in Switzerland is Reyl & Cie SA, Rue du Rhône 62, CH-1204 Geneva. The prospectus, the KID, the fund regulation and the annual and semi-annual reports may be obtained from Reyl & Cie SA. Daily publication of the net asset values of the Units offered in Switzerland: www.fundinfo.com

CHILE:

In Chile when the Sub-Fund has been registered for distribution by the Comision Clasificadora de Riesgo (CCR) in Chile exclusively to Chilean Pension Funds under Agreement Nr 32 of the CCR, this document is not intended to investors who do not qualify as a Chilean Pension Funds. To find out whether this Sub-Fund is registered with the CCR, please refer to www.eurizoncapital.com.