Eurizon’s sustainability policy

3 minutes

3 minutes Consistently with European law (Regulation EU 2019/2088, so-called Sustainable Finance Disclosure Regulation), Eurizon has adopted a Sustainability policy that illustrates how sustainability risks are integrated in the investment decision process, defining specific methodologies to select and monitor financial instruments, that take into account sustainable and responsible investment (SRI) principles, and environmental, social, and governance (ESG) factors.

The ESG/ SRI strategies adopted by Eurizon

Please note that with effect from 1 December 2025, the 'Process to integrate sustainability risks in the managed assets investment process' (paragraph 5) and the 'Methodology for identifying sustainable investments' (paragraph 7, 'Sustainable investments') of the document “Sustainability Policy of Eurizon Capital SGR S.p.A. – Luxembourg Branch” will remain in force for all collective investment undertakings (the 'Funds') established by Eurizon Capital SGR S.p.A. – Luxembourg Branch as of 31 December 2024. For funds established or updated on or after 1 January 2025, the reference document is the “Sustainability Policy of Eurizon Capital SGR S.p.A. 2025.

For more details on the Sustainability Policy of Eurizon Capital SGR S.p.A. 2025

| Sovereign Sustainability Ambition (SSA) Framework - Classification of countries |

| Thresholds for the application of the ‘Do No Significant Harm’ (DNSH) principle |

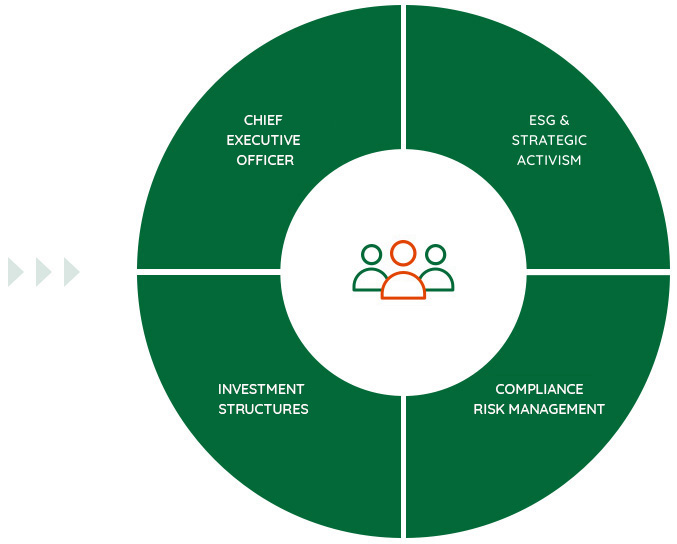

The main players involved in the ESG/SRI process

ESG Committee

Draws up the proposals to present to the BoD on sustainability themes, monitors the exposures of assets under management with respect to ESG indicators, and oversees engagement on external corporate governance activities

Sustainability Committee

Works with the BoD to guarantee that Ethical Fund investment decisions are in line with the rules for these funds. The Committee is independent and autonomous from the AM Company and is made up of personalities of acknowledged probity and morality

Devolutions Committee

Supervises the donations and charity activities of the funds that belong, among others, to the Ethical system as well

Investment Supervision Committee

Tasked with advisory, drafting, and propositional activities related to the supervision of the Investment Process used in managing funds

Financial, Credit and Operational Risk Committee

Monitors the impacts of sustainability risks on financial products, and the mitigating actions adopted to face the adverse effects tied to investment decisions